I asked ChatGPT for a summary of the best evidence review I could find - Diris & Ooghe (2018) - “The Economics of Financing Higher Education”. Here’s what it has to say:

This study examines the economic arguments for and against tax-financed subsidies in higher education and evaluates alternative funding mechanisms, such as income-contingent loans (ICLs) and graduate taxes (GRTs). The key findings are:

1. Arguments for and against Tax-Financed Higher Education

• Against: High private returns to education provide sufficient incentives for students to invest, while tax-financed subsidies may be regressive, as they are partially funded by lower-income non-students.

• For: Higher education may generate positive externalities, alleviate credit constraints, provide insurance against income risk, and correct behavioural biases (e.g., students underestimating future benefits).

2. Private vs. Social Returns on Higher Education

• Across OECD countries, private incentives to pursue higher education are strong due to high private returns.

• Policy should be guided by social returns, incorporating both efficiency (maximising human capital investment) and equity (ensuring fair distribution of costs and benefits).

• Tax-funded subsidies tend to be regressive, particularly when viewed from the perspective of future taxpayers rather than current parents.

3. Alternative Funding Models

The study compares four higher education funding modes:

1. General Tax-Financed Subsidies: High public funding, distributed via institutions or grants. Often regressive.

2. Classical Loans: Fixed repayment obligations, exposing students to income risk.

3. Income-Contingent Loans (ICLs): Repayments depend on future income, offering better risk-sharing than classical loans.

4. Graduate Taxes (GRTs): A tax levied on graduates’ income over time, ensuring that only beneficiaries of higher education bear the cost.

4. Equity and Regressivity of Different Funding Models

• Regressivity Analysis:

• Parental View: In some countries, tax-financed subsidies disproportionately benefit wealthier families, making them regressive.

• Student View: Non-students contribute to the cost of higher education without benefiting, reinforcing the argument that tax-funded subsidies are regressive.

• ICLs and GRTs are better at balancing equity and efficiency than general taxation or classical loans.

5. Efficiency Considerations

• Externalities of Higher Education:

• The study finds limited empirical support for large externalities that would justify strong government subsidies.

• Pecuniary externalities (e.g., higher productivity) are small, while non-pecuniary externalities (e.g., higher civic engagement) are harder to quantify.

• Fiscal externalities (higher taxes paid by graduates) do not seem large enough to offset subsidy costs.

• Credit Constraints & Insurance:

• Rising tuition fees increase the risk of credit constraints for lower-income students.

• ICLs and GRTs provide better insurance against income risk than classical loans.

• GRTs offer the highest level of insurance, as they spread the cost among all graduates.

6. Policy Recommendation: Shift Towards Graduate Taxes or Income-Contingent Loans

• Given the evidence, the authors conclude that tax-financed subsidies are a blunt instrument for addressing the key failures in higher education finance.

• GRTs and ICLs are preferable for many OECD countries due to their ability to align contributions with earnings and provide insurance against post-graduation income risks.

Conclusion

• A graduate tax is an efficient and equitable alternative to tax-financed subsidies, ensuring that only graduates contribute while reducing financial barriers to entry.

• The study suggests that countries with high tax-financed subsidies or high tuition costs should consider transitioning to ICLs or GRTs for a more balanced funding model.

This provides academic support for the claim that graduate taxes are a viable and potentially superior way to fund higher education, compared to general taxation or classical student loans.

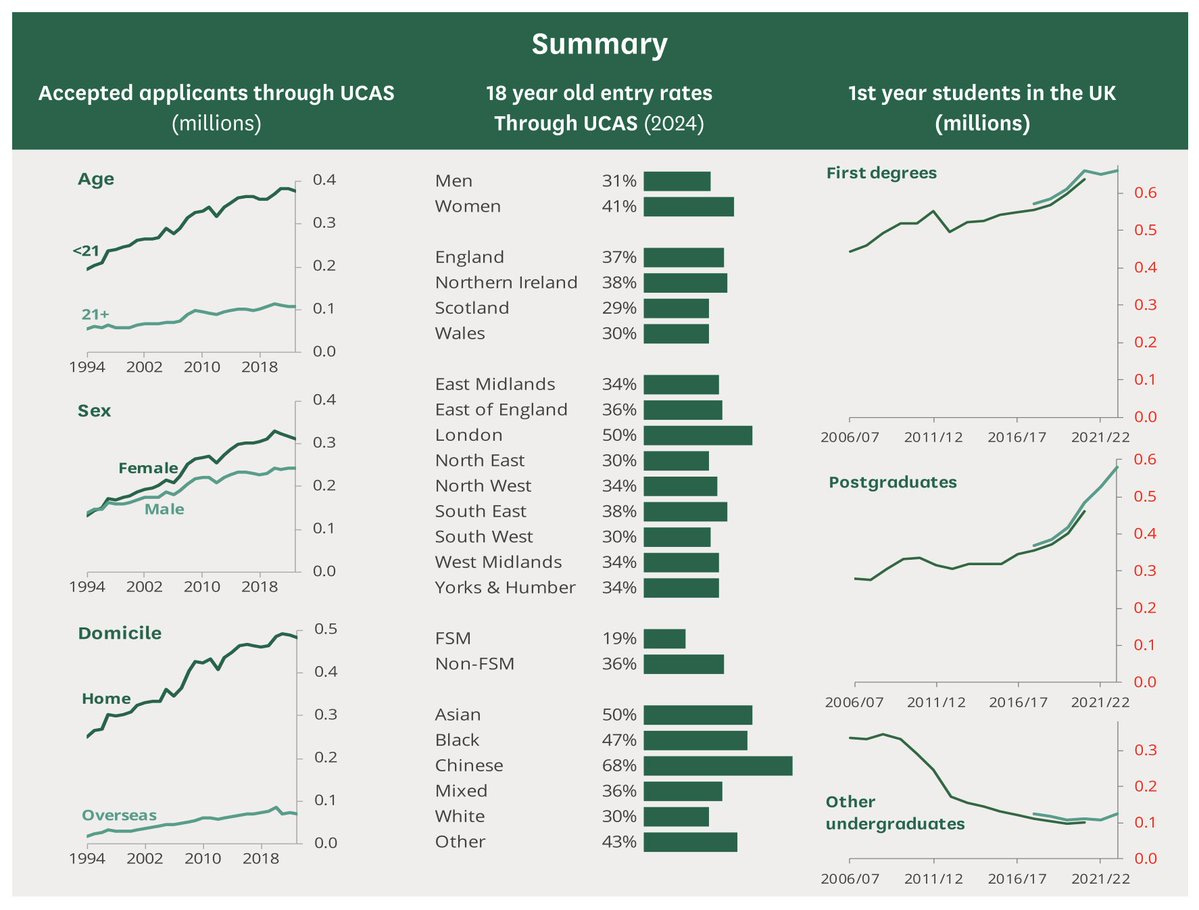

It seems to me that the argument in favour of tuition fees and graduate taxes is very solid indeed. The British model seems to have worked particularly well:

As a side note, asking ChatGPT for summaries on evidence reviews is proving a good way to learn about subjects directly from experts, avoiding the biases and dumbing down of the mainstream media.